May 20, 2020, 6:00 AM

By Emily Chasan

Not many ESG fund managers set out to protect investors from a global pandemic. But their funds have nevertheless proven resilient during the subsequent market collapse.

With the benefit of hindsight, it’s easy to see how fund managers avoided risk by using ESG scores as a proxy for well-managed, adaptable companies, or planning for an existential climate shock. In this way they prioritized technology, financial services and health-care stocks, as well as renewable energy. Even the world’s biggest investors seem a little surprised at how much downside protection ESG funds offered during the coronavirus crash. Allianz, BlackRock, Invesco and Morningstar all found that ESG investments have been outperforming traditional ones in 2020. A study this week from BlackRock found that more than three-quarters of sustainable indexes did better than traditional indexes in market downturns from 2015 through 2018. In the first-quarter’s Covid-19 market drop, 94% of sustainable indexes outperformed, the study found.

“When we think about saving for the long-term, we really want to ensure we’re mitigating downside for retirement savers,” Stacey Tovrov, a director of retirement investment strategy at BlackRock, said Tuesday at an event hosted by the World Business Council for Sustainable Development. “Sustainable investment can provide that resilience amid uncertainty.”

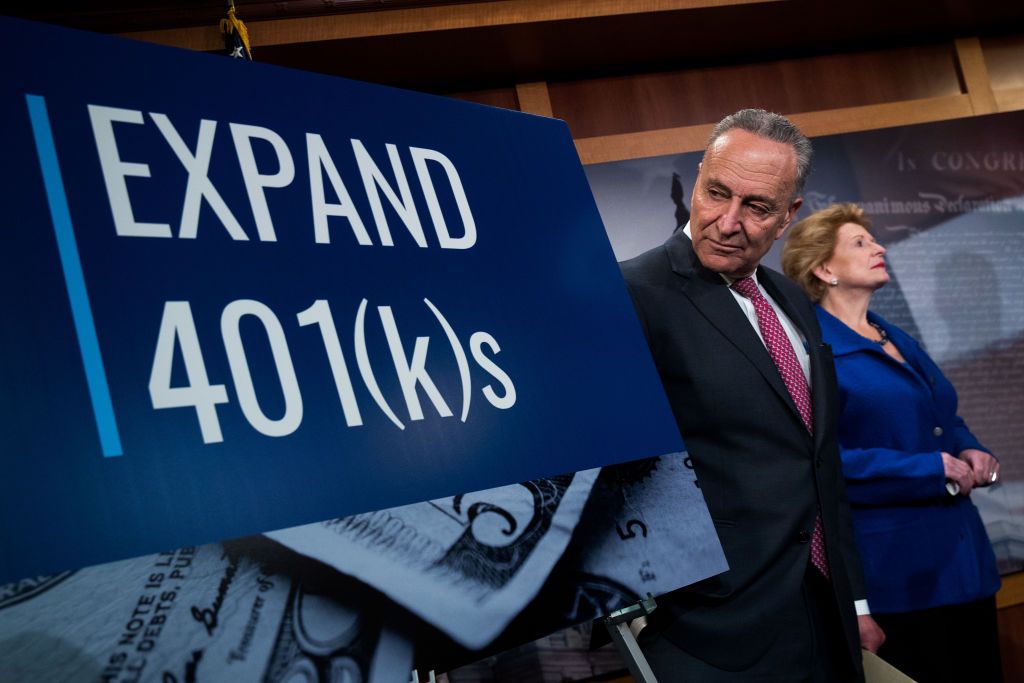

But that raises the question of why ESG funds are largely missing from a $9 trillion chunk of the market: company retirement plans. Before the bottom fell out this year, U.S. retirement assets accounted for 33% of all household wealth. That’s often the biggest pool of investable assets, especially for millennials. But only about 3% of 401(k) plans offer the option of investing in an ESG fund, and less than 1% of all 401(k) assets are actually invested in ESG-specific funds, according to Natixis Investment Managers.

“People believe that with ESG investing you are sacrificing returns, but that’s not the case,” said Jim Roach, senior vice president, retirement strategies, at Natixis. “Economies have changed and the world has changed, and we too have to change the way we are asked to invest.”

U.S. retirement plans face significant oversight and are historically slow to change. But companies worried they would be violating their fiduciary duty by including ESG funds have less of an argument these days. There are now 79 U.S. funds with a five-year track record and at least $100 million in assets—and they’ve shown how well they can perform in a down-market. While ESG funds won’t be right for all workers, they are clearly pointed toward the kind of pandemic- and climate-aware world workers expect. Most target-date funds holding the majority of 401(k) plan assets don’t incorporate ESG, and employees may want to chew on that.

The coronavirus is likely to reshape the fundamental relationship between employers and employees. Addressing worker health and safety has been the biggest test yet of CEO commitments to stakeholder capitalism. But many workplaces still come up short on protective equipment, avoiding virus outbreaks and exorbitant CEO pay, so those supposed commitments remain understandably hard for employees to believe.

One place to start changing that attitude might just be offering workers the chance of a more resilient retirement.

Sustainable Finance In Brief

- Fund managers, including BlackRock and State Street, are falling far short on protecting human rights.

- Shareholders concerned with fossil fuel financing at JPMorgan lost their campaign to remove board members. A proposal to align bank activities with global climate goals narrowly missed approval.

- Citigroup is adding an investment banking division focused on sustainability after its coronavirus experience.

- Natixis said it would give up shale financing weeks after disclosing a large financial hit from bad oil loans.

- Cleaner air is actually a problem for California’s cap-and-trade system.

- Green bonds are struggling as a systemic solution to climate change.