(Bloomberg Businessweek) —

James Cox counts himself lucky. The owner of a 687-acre farm in Gloucestershire, a bucolic county in the southwest of England known for its quaint villages and rolling landscape, bought all his fertilizer for the 2022 planting year well before the recent surge in prices—meaning he had enough to feed his wheat and oats, as well as the barley that’s just sprouting. And he doesn’t intend to use it all.

“We are already considering reducing to some extent how much fertilizer we put on this year’s crop so we have some left over for next year,” Cox says, citing soaring prices for synthetic nutrients. He’s trying to calculate exactly how far he can stretch his reserve without compromising the quality and quantity of his harvest. “How much dare we trim the fertilizer back from what we were originally planning to use and how much will that impact the crop margins for this year?”

Commercial farmers the world over are asking the same question. Costs for the chemical fertilizers that power modern agriculture—nitrogen, phosphorus, and potassium—were already soaring in 2021 for a variety of reasons: a runup in natural gas, the primary feedstock for much of the nitrogen fertilizer produced globally; late summer storms on the U.S. Gulf Coast that temporarily closed plants in the region; government sanctions on a major Belarusian potash producer in response to a journalist’s arrest; and growing resource nationalism on the part of countries such as China, the largest phosphate producer, which began restricting exports last year.

And that was all before Ukraine was invaded by Russia, a major low-cost exporter of every type of crop nutrient, giving prices a fresh jolt—in North America, one gauge shows they’ve almost doubled from a year ago. As with many other commodities, the world has in recent decades increasingly come to rely on Russia for its fertilizer needs. In 1992, the year after the dissolution of the Soviet Union, the country’s production of nitrogen amounted to 4.9 million nutrient tons, close to 7% of worldwide consumption, according to data compiled by the International Fertilizer Association (IFA) and Green Markets, a Bloomberg company. By 2019, that had risen to almost 10%. The country’s global share in phosphates and potash also climbed, to about 8% and 20%, respectively.

Since the war began, fertilizer shipments out of Russia have been severely disrupted, with some domestic producers intentionally holding back supply in response to Western sanctions and many major shipping lines unwilling to touch the product if they could even get it. Shortages in Brazil, the top destination for Russian shipments, as well as in other countries that rely on Russia for supplies, including India and China, could result in smaller harvests and higher crop costs. The Food and Agriculture Organization warned in a report last month that food and feed prices could climb by as much as 22% in the 2022-23 marketing season as a result of the conflict in Ukraine, increasing the risk of malnutrition and even famine.

Amid such dire predictions it may sound callous to talk of silver linings. Yet the fertilizer shock of 2022 could ultimately end up paying dividends similar to those of the twin oil shocks of the 1970s. The Arab oil embargo brought the U.S. economy to its knees, but it also kick-started an energy conservation drive that reshaped the American auto and building industries, to name but two. Under pressure from Asian competitors, Detroit’s Big Three introduced more compact, fuel-efficient cars. Meanwhile, advances in lighting, insulation, and appliances reduced home energy use.

Because of the sum of innovations like these, the global economy is much less oil-dependent than it used to be. In 1973 it used a little less than one barrel of oil to produce $1,000 worth of gross domestic product (at 2015 prices). By 2019, it was down to 0.43 barrel—a 56% decline.

More efficient use of fertilizers could likewise yield big benefits for the planet. Patented in the early 1900s, the Haber-Bosch method used to convert hydrogen and nitrogen into ammonia rates as one of the most important discoveries in history. It’s estimated that without nitrogen fertilizer, the planet would only be able to support approximately half our present-day population of 7.9 billion. But there are downsides. Production of synthetic ammonia emits more carbon dioxide than any other chemical-making process.

The damage doesn’t stop there. Microbes present in soil break down fertilizer, releasing nitrous oxide into the atmosphere, which pound for pound has 300 times the planet-warming impact of CO₂. Synthetic nitrogen is also a threat to biodiversity. Much of what’s used on crops gets washed away by rains or floods and finds its way into rivers, lakes and oceans, where it unleashes algal blooms that create oxygen-depleted dead zones that can’t sustain life. One of the largest, in the Gulf of Mexico, is bigger than the state of Connecticut.

“Producing more with less” is how Patrick Heffer, IFA’s deputy director general, frames the challenge to farmers. In many countries, growers have already been experimenting with ways to use synthetic crop nutrients more efficiently. By using techniques such as rigorous soil testing and so-called precision agriculture, food producers can figure out just how much nutrition their land needs in a given growing season—and apply not a teaspoon more. Innovations include so-called controlled-release formulations, usually tiny capsules that dissolve gradually when they come into contact with moisture, releasing nutrients.

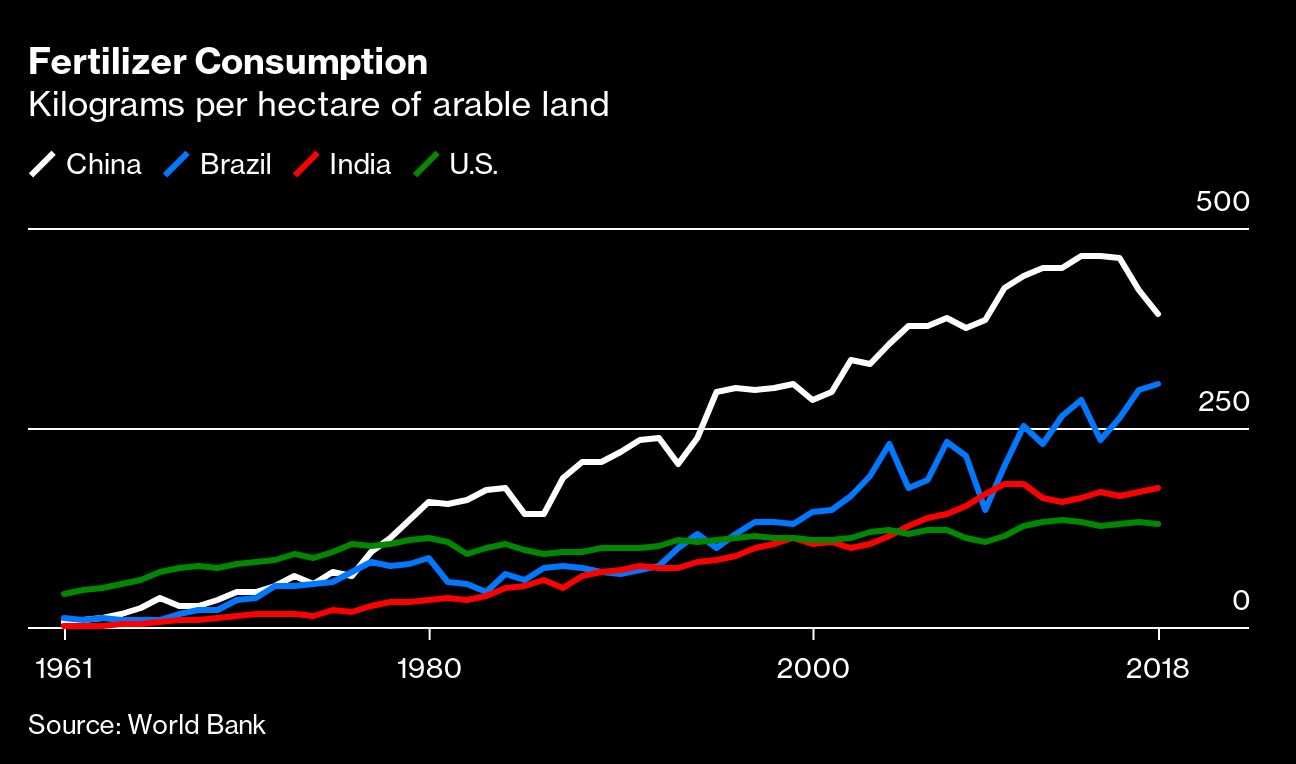

In Brazil, where fertilizer use has been growing faster than in the U.S., the demand for soil testing is at an all-time high this year, says Renato Alves Filho, chief executive officer of Laboratório Solos & Plantas, the biggest agronomic analysis chain in the country. The company processed 21,000 samples in the first 90 days of the year, compared with 12,000 for the same period in 2021, he says. Similarly, in the U.S., Corey Lacey, president of the Agricultural Laboratory Testing Association and a laboratory manager for United Soils in Fairbury, Ill., forecasts that this will be one of the biggest years for testing in decades.

Education also has a role to play. In China, a 10-year pilot project to provide land management training to 21 million small landholders achieved a more than 10% increase in yields on average over the decade, while nitrogen fertilizer use decreased by as much as 18%.

Since all of the world’s top agricultural producers expend significant sums on farm subsidies, government policy could be used to prod changes as well. In November, the European Parliament voted to adopt a Farm to Fork strategy that targets a 20% reduction in fertilizer use by 2030.

Sri Lanka showed the rest of world the importance of not moving too quickly. Last April, its government imposed a ban on synthetic fertilizers as part of an effort to quickly transition the country to organic farming. The policy was rolled back in November in response to protests by farmers and soaring food inflation. But the damage had already been done. Officials predict rice paddy production will drop by up to 30% in the current season, while the tea crop, a key export, has also suffered.

Humankind may never manage to completely wean itself off synthetic fertilizer. According to projections, food production will have to increase 70% by 2050 to sustain the planet’s growing population. Sub-Saharan Africa has the world’s highest birthrates but the average application of fertilizer there is approximately one-eighth of the global average. Many believe that level is too low.

In Brazil, many farmers are steeling themselves for an unnerving season of trial and error. Napoleão Rutilli, who farms 4,200 acres in Diamantino, in the heartland of the country’s grain belt, is waiting for the end of the winter-corn harvest around June before testing the soil and deciding how much fertilizer he’ll need for his next planting of soybeans. Those tests will be key, seeing as he hasn’t yet bought any nutrients for the next planting. “I’ll change the way I work,” says the second-generation farmer. “We need to reinvent ourselves.” —With Tatiana Freitas and Tarso Veloso Ribeiro

Read next: How to Grow Strawberries Indoors? Vertical Farm Expands From Greens to Berries

To contact the authors of this story:

Elizabeth Elkin in New York at eelkin4@bloomberg.net

Samuel Gebre in London at sgebre@bloomberg.net

Matthew Boesler in New York at mboesler1@bloomberg.net

© 2022 Bloomberg L.P.